Automation is powerful—but only when configured correctly. Many traders overlook key optimization steps that can significantly improve their Posting Trader workflow and reduce execution errors.

Fine-Tuning Strategy Logic for Cleaner Automation

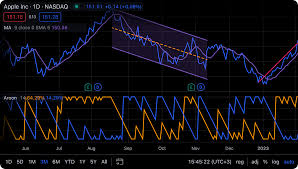

Traders often rely heavily on their alert source TradingView, TrendSpider, or other platforms but forget that execution logic matters just as much as signal quality. Proper parameter tuning, filtering conditions, and risk management rules ensure that automated trades behave exactly as expected. Posting Trader simplifies the backend, but users still benefit from refining their strategy logic before connecting it to automation.

Improving Execution Timing and Reducing Latency

Another overlooked area is execution timing. Markets move quickly, and even a small delay between alert generation and broker execution can impact performance. Reviewing alert frequency, strategy complexity, and broker availability can help streamline the entire process. Traders who optimize latency often see more consistent results and fewer slippage-related issues.

Practical Recommendations

- Review automation logs regularly to catch configuration issues early.

- Use multiple confirmation signals before sending automated orders.

- Keep alert messages lightweight to ensure faster processing.

- Backtest strategy changes before deploying them in automation.

- Set clear stop-loss and take-profit rules directly in the broker or via the strategy.

Optimizing an automated strategy doesn’t require coding—just attention to detail. With these practices, Posting Trader users can achieve cleaner execution, higher accuracy, and a more reliable trading workflow.